Posts

That is because you can also are obligated to pay state otherwise regional taxation to your your betting winnings. Without all the state offers tax-free playing, thankfully, there are various you to don’t take a huge amount from your own payouts. A few claims taxation earnings during the relatively low rates compared so you can someone else. Which can indicate you to, in a few claims around the border, it can be value crossing condition traces to try out that have down playing taxes. You ought to statement all the betting profits to your Mode 1040 or Function 1040-SR.

Never predict your friend that is running an office pool, such as, to help you keep back taxes (whether or not, commercially, they need to). Gambling fees are typical because the Western playing industry is booming. From the new casinos so you can lotteries an internet-based wagering, there are numerous opportunities if you love gaming. And investigation in the American Gaming Connection reveal that you wouldn’t getting alone. As we know, slot machine jackpot payouts from $step one,2 hundred or higher need a W-2G taxation form. The brand new antiquated endurance, that has been fixed since the 1977, has significantly enhanced how many W-2G variations submitted yearly.

Create I want to spend income tax for the gambling payouts on the Us?

However, if you’d like to learn more about how your own gambling earnings has an effect on the fees, read on. Within website, we are going to look into the brand new tax ramifications from online gambling profits, finding out how he is taxed, tips declaration him or her, and also the certain laws and regulations one to apply at all sorts of on the web betting. We are going to along with go through the role of one’s gambling app advancement company, betting app innovation agency, and you will sports betting app builders relating to conformity with income tax regulations. Towards the end, you’ll has a very clear knowledge of exactly how the profits are taxed, as well as how developers and you will workers can help ensure conformity. You could deduct your losses merely around the amount of their overall gambling payouts.

Just how Gambling Earnings Is actually Taxed

Although not, simply people that receive a retirement considering work not secure from the Public Security may see benefit expands. Very condition and you can local personal staff – in the 72 percent – are employed in Societal Security-secure https://intersel.com/%e0%b8%aa%e0%b8%b2%e0%b8%a2%e0%b8%81%e0%b8%b2%e0%b8%a3%e0%b8%9a%e0%b8%b4%e0%b8%99-1xbet-%e0%b8%9c%e0%b8%b9%e0%b9%89%e0%b8%a3%e0%b8%b1%e0%b8%9a%e0%b8%9e%e0%b8%99%e0%b8%b1%e0%b8%99%e0%b8%97%e0%b8%b5/ employment where they pay Societal Security taxes and they are perhaps not influenced by WEP or GPO. Those individuals does not receive good results raise due to the the fresh law. To get more certified on the internet providers regularly raking inside the money, “the sales should be claimed on your own company tax return otherwise to your Schedule C of one’s own tax return,” said TaxSlayer. You simply can’t personally subtract funding losings from the fees, you could fool around with funding losings to offset development.

Dining table Online game

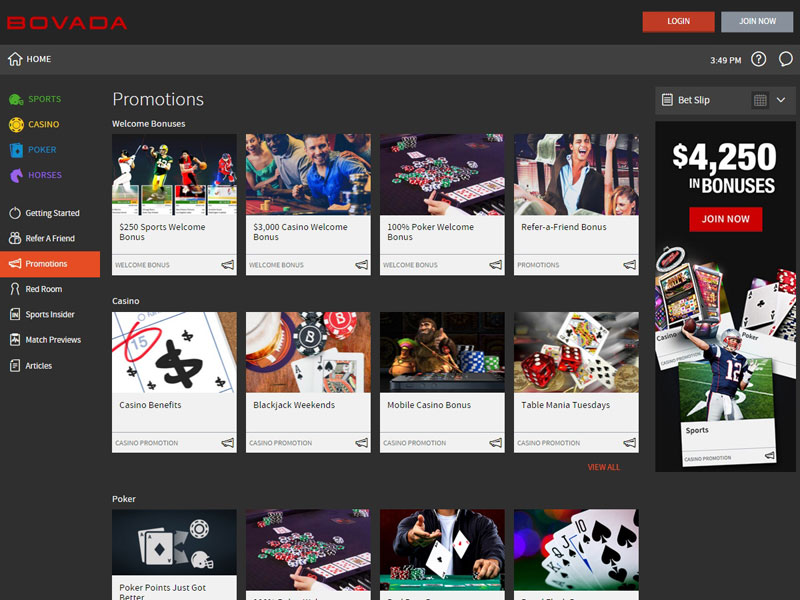

- There are several finest You gambling enterprises that provide a few of the better invited incentive offers and regular promotions.

- Even if you don’t explore financial cable transmits or any other financial-associated on line commission actions, financial statements make it easier to substantiate loss by the showing associated Atm withdrawals and so on.

- As the a casino player, it’s important that you learn and discover the country’s taxation code.

However, he’s at the mercy of notice-employment taxation (Schedule SE). One to taxation (comparable to Social Defense and you can Medicare) try 15.3% of the very first $90,one hundred thousand of income (2005 restrictions) and you can 2.9% after that. You will do can deduct half of yourself-a job taxation because the a modification to help you money on the internet 30 out of Mode 1040. For the majority of bettors, it’s lower (for fees) getting a beginner than just a professional. Correspond with an expert tax mentor prior to making the decision to be a professional gambler.

This is where the newest payer of them earnings may need to be given a social defense number to stop withholding. As much as i dislike hearing the definition of, taxes is actually something which no internet casino player can be end. In the usa, there’s extremely quick regulations to the gambling and you may fees, and this we are summarizing below. Lower than § 4421(1), the phrase “wager” comes with one wager listed in a wagering pond, in the event the for example pond is performed to have funds, and you can people choice placed in a lottery conducted for cash.

Setting 1099 records various income of at least $600 inside awards and you will honors, among other things. Gambling enterprises and you will sportsbooks post function W-2G (Particular Gaming Earnings) to your Irs Center and a duplicate to the Condition, Area, or regional tax department. County and you will local governing bodies collected approximately $35 billion away from variations from betting inside the fiscal seasons 2021.

Web based poker – competitions and you can Fees

The very last thing to your somebody’s notice after hitting a great jackpot otherwise flipping a king out of clubs on the Progressive Pai Gow Web based poker payout is the tax boy. The quantity withheld might possibly be placed in Field 4 of the W-2G function you’re going to get. You will also have so you can indication the new W-2G stating lower than penalty of perjury, the information listed on the form is right. I rely on Jane to share with all of our customers in regards to the current slot game in america business.

Anyhow, should your choice are with a gambling establishment, we have been rather particular you will get the brand new W-2G. Yet, if your bet was just a friendly wager which have a great buddy or if you won an office pond … well, never rely on it. The Congressional Gambling Caucus is to begin with designed regarding the twentieth millennium. It had been intended to be a vehicle for gambling and you will casino organizations to have the state to the Congressional items. Chief Deputy Whip Kid Reschenthaler and Associate Dina Titus would be the bipartisan Congressional Betting Caucus co-seats.

But not, you’ll want ironclad records to show those people losings in the event the audited. Gambling games which can be video poker (random number generated software-based) game also are treated as the ‘Ports.’ Including gains try claimed by the an internet gambling enterprise for your victory out of $step 1,two hundred or higher. To have wagering, most states levy a condo income tax rate to the an excellent sportsbook’s revenues, with prices anywhere between six.75 % within the Iowa and Nevada to help you 51 per cent within the The newest Hampshire, Nyc, and you can Rhode Isle.